Distributed energy. What is it?

Small-scale distributed energy is a concept of energy development that provides opportunities for transition from the traditional organization of energy systems to new methods and practices. This transition is carried out in conditions of decentralization, digitalization of energy systems, using different types of energy resources, with the aim of increasing energy efficiency, reducing environmental impact on the environment.

The most developed component of the distributed energy sector in Russia is distributed generation, which represents complete power facilities with a capacity of up to 25 MW located near the consumer.

It should be noted that due to the emergence of new technologies, the approach to the development of energy systems has changed. Combining a large number of distributed generation facilities into a "smart grid" ensures high reliability and flexibility of the system operation.

Currently, small-scale distributed power generation is the only effective tool to reduce the cost of electricity for small and medium-sized businesses. The possibility of small distributed power generation equipment operation on different types of fuel (including liquefied gas) allows installing such facilities in territories with a wide geography.

Mini-HPPs produced by MKS Group

Share of small-scale distributed power generation in the world

Small-scale distributed power generation has been a leading trend in the development of the global energy industry for several decades and, according to experts, this trend will continue in the next decade. Navigant Research forecasts a three-fold gap of new inputs of distributed generation capacity over the centralized one by 2026 in the world. SCC Research estimates the size of the global market for distributed generation technologies at $65.8 billion in 2015. It is expected to grow from $69.7 to $109.5 billion in the period up to 2021 at an average annual growth rate of 9.5%.

Forecast of commissioning of new capacities of centralized and distributed generation in the world (MW):

Share of small distributed power generation in Russia

There are certain difficulties in estimating the share of small distributed power generation in Russia and analyzing changes in the indicators of this industry, since the main regulators of this sphere - the Ministry of Energy of Russia and the System Operator of the Unified Energy System - do not single out these indicators when preparing official public reports.

Currently, distributed generation facilities in Russia account for about 7% of the total volume of electricity generation. This indicator is two times lower than the global indicators. However, distributed generation as a phenomenon has already taken place in Russia, and this industry is actively developing.

Mini TPPs produced by MKS Group

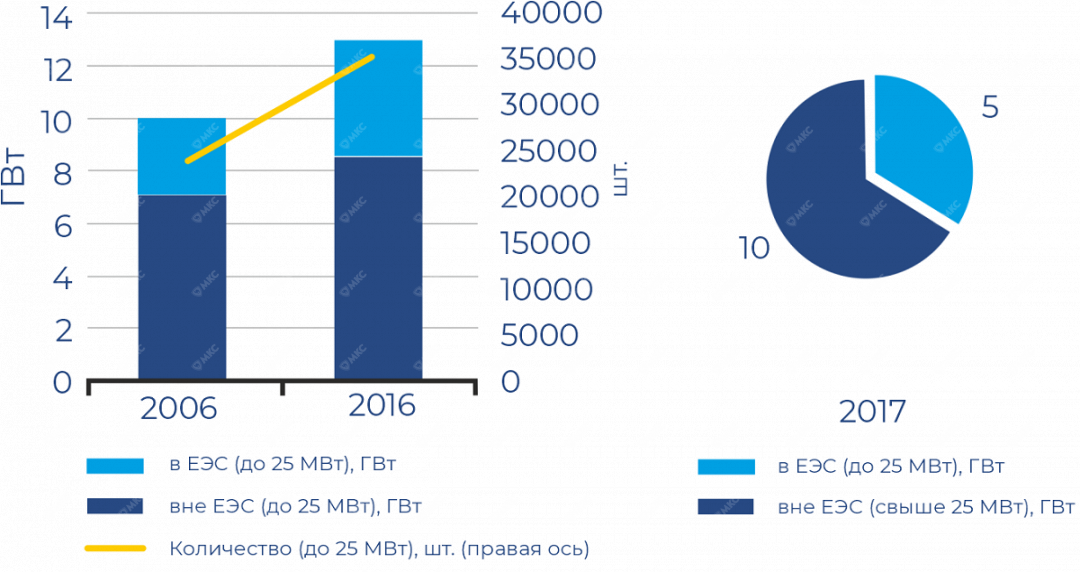

Detailed indicators of the development of this industry are given in the study of the Energy Center of Skolkovo Business School "Distributed power generation in Russia - development prospects", released in January 2018. According to Rosstat, 36 thousand power plants with a capacity of 25 MW or less were operating in Russia in 2016, and their total capacity amounted to 13 GW. Approximately 8.5 GW of this capacity is operated in the area of decentralized power supply. Compared to 2006, the increase in capacity amounted to about 3 GW. The main part of the mentioned facilities is TPPs, which account for 92% of the total capacity (the remaining 8% is accounted for by solar, wind and other plants).

Also according to Rosstat data as of 2017, the total capacity of distributed generation facilities in Russia can be estimated at about 23-24 GW, and the share of distributed generation capacity in the total volume of electricity generation in the country is 9-9.5%.

Data for 2006 and 2016 are presented on the basis of INEI RAS calculations based on Rosstat data; data for 2017. - based on McKinsey&Company calculations.

Most of the projects in the distributed generation industry are implemented using cogeneration.

Factors for increasing the growth rate and capacity of the small-scale generation market

The main factors for increasing the growth rate and capacity of the small-scale generation market in the next 3 years include:

Significant increase in the cost of electricity

External energy sales and resource supply organizations typically increase tariffs for resources and services twice a year. The electricity pricing system is fully market-based.

High costs of electricity transmission

Grid companies set an ever-increasing tariff for electricity transmission through trunk and distribution grids.

Non-transparent pricing process

The tariff system for resource supply and services is non-transparent and inaccessible on centralized power supply systems, there is confusion in the chain of network owners and their contribution to the total cost, and a complex pricing process in the centralized retail electricity sector.

Expensive and time-consuming technological connection

Today, the energy complex of the Russian Federation is universally characterized by significant terms of technological connection of power receiving devices to centralized power supply networks, high cost of technological connection, complicated mechanism of coordination and approval between power industry entities, and lack of technical connectivity.

Uneven and remote location of new industrial facilities (field facilities) from centralized power sources

With the economic development of the Russian Federation, the number of new industrial facilities located in the Arctic and remote areas (Kamchatka Territory, Republic of Sakha (Yakutia), Yamalo-Nenets Autonomous Okrug, Sakhalin Region, etc.) far from the centralized power system increases every year.

Need to replace worn-out capacities and improve reliability of power supply

One of the global problems of Russia's energy industry is high wear and tear of fixed assets in the energy complex, high accident rate, planned and unplanned outages.

Potential for development of distributed generation in Russia

According to a study by the Energy Center of Skolkovo Business School, the potential for development of distributed cogeneration may be due to the following factors:

Increase in the capacity of facilities for the possibility of replacing large CHPPs on the heat market

According to the study of the Energy Center of Skolkovo Business School, if these facilities are decommissioned without renewal, heat supply from existing CHPPs will decrease relative to 2016 by 26% by 2025 and by 30% by 2035.If old CHPP capacities are replaced by new facilities with full load in the thermal schedule, their capacity may amount to about 20 GW on the horizon of already 2025-2030. If smaller CHPP capacities are decommissioned, the potential of distributed cogeneration in this sector will decrease proportionally.

Increase in demand for heat energy from centralized sources

In the country as a whole, this indicator relative to 2016 is estimated by INEI RAS as only 6% by 2035. At the same time, it is expected that with the support of heating, as the most efficient method of energy supply, heat supply from CHPPs will grow faster, and will increase by 7% by 2025 and 26% by 2035. If the entire increase in the demand of new consumers for heat energy from CHPPs is provided only by distributed cogeneration facilities, their electric capacity may amount to about 18 GW by 2035.

Commissioning of additional distributed cogeneration facilities instead of existing boiler houses

According to INEI RAS estimates, these facilities can, at least, fully cover the remaining forecasted need for additional generating capacities. At the same time, the annual heat generation at boiler houses will decrease, while the electric capacity of new distributed cogeneration facilities may amount to about 30 GW by 2035.

The analysis of factors determining the potential of distributed cogeneration is presented on the basis of INEI RAS data:

Small-capacity distributed generation facilities (up to 25 MW) refer to in-house generation facilities, the construction of which is also carried out by third-party investors to gain profit on the electricity and heat markets.

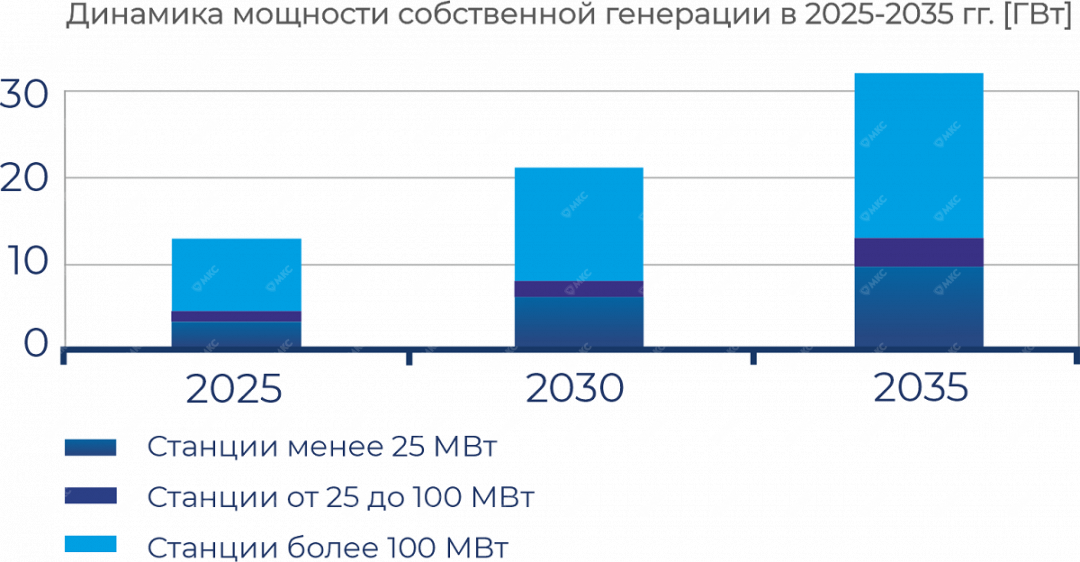

The study by the Energy Center of Skolkovo Business School based on data from Rosstat, SO UES and McKinsey&Company presents the dynamics of in-house generation capacity in 2015-2035.

Extrapolation of the trends in this segment over the last 10 years allows us to assume that at least 12 GW of additional capacity will be commissioned by 2035 (small and medium-sized generation), and in the high scenario - up to 32 GW (small, medium and large generation).

Distributed generation technologies

A multitude of distributed generation technologies cover installations up to 25 MW, including non-conventional and renewable energy sources (RES). The most known and studied among them are the following technologies:

In addition to the above technologies and installations, microturbines, stirling engines, rotary vane engines, energy storage devices (chemical, inertial, gravity, etc.), chillers (air cooling apparatus), etc. also seem promising.

Another promising area of distributed generation is the use of associated petroleum gas (APG) at oil and gas enterprises.

Renewable energy

Renewable energy is a direction of alternative energy based on the use of practically inexhaustible resources for electric power generation (solar, wind, river, sea, geothermal, etc.).

Autonomous Hybrid Power Plant

Wind Power Plant

Renewable energy has both advantages and disadvantages.

Advantages:

renewable energy source;

environmentally friendly energy source;

low cost of electricity.

Disadvantages:

complete dependence on external conditions;

unstable energy quality;

high cost;

the need for additional equipment;

low CIUM.

Gas distributed generation - the most efficient technology for small-scale power generation

Today the small-scale power generation industry based on the use of mobile and highly efficient gas piston units is a modern, efficient and highly profitable type of energy business that has been rapidly gaining popularity in recent years.

Mini-HPPs produced by MKS Group of Companies

The world prerequisites for the development of gas-fired generation are:

Affordable fuel

Natural gas is the most affordable and efficient type of fuel in the perspective for the next 30-40 years.

Gradual phase-out of coal fuel

Coal is an expensive and unecological fuel. In particular, this has recently been confirmed by the transfer of large power plants to gas fuel supply.

Decrease in the share of nuclear power

Nuclear power is an expensive type of power generation with a high share of technological risk. This fact is confirmed by the winding down or reduction of the share of nuclear power generation in energy projects in Russia and worldwide.

High efficiency of cogeneration and trigeneration

Thermal small-scale generation on the basis of GPU is a highly efficient method of power generation, which allows to obtain associated types of energy (heat and cold).

Small-scale distributed generation equipment. GPU

Gas-piston units (GPU) is an internal combustion engine with external mixture formation and spark ignition of the combustible mixture in the combustion chamber. The GPU uses gas as fuel. The heat is recovered by means of a heat exchanger, which increases the overall efficiency of the plant.

Advantages of GPU:

high electrical efficiency (40-44%);

extended service life (up to 240,000 h);

optimization for both parallel and autonomous operation;

extended service intervals;

extended life before capital repairs;

possibility to operate on different types of gaseous fuel;

relatively low cost of the unit.

Disadvantages of GPU:

additional operating costs (oil, plugs);

utilization of at least 40%.

What small-scale energy gives to the consumer

The question of what small-scale energy gives to the consumer and what motivates those who build distributed generation facilities can be answered briefly - reduction of tariffs for energy resources. But, of course, not only that. The most important thing is the location of the generation facility near the consumer, due to which the consumer saves on transportation of energy, electricity and heat, reducing the cost of the final product. There are also other important points, for example, improving the reliability of power supply.

Another important argument is the speed of capacity commissioning. If we take grid companies into account, technical connection, taking into account the construction of lines, can take years. On average, it is about two years, and that is provided that there is free capacity in the relevant power center. If there is none, it will take longer. This is because the procedure for connecting new facilities in Russia is competitive, associated with the registration of land plots, linear construction facilities, etc. For comparison: the minimum period for launching small-scale power generation facilities is about 8 months. That's fast enough.

Mini-HPPs produced by MKS Group

Of course, to build your own mini-HPP, you need investments. However, the amount of investment varies depending on the power plant capacity and options for its realization. The cost of one kilowatt can be estimated in the range from 500 to 650 euros. This is much lower than the cost of large energy facilities (TPPs, CHPPs). This means that the payback period is more interesting - 3-4 years. At the same time, heat is also sold, which is a significant component of the economy. Taking into account the reduction in its cost, the payback period will be even shorter.

At the same time, it is important to realize that small power is not against big power. They practically do not compete. It all depends on the task at hand. It's like in aviation: there are big airplanes - Boeings, double-decker A380 airliners. There are small planes, literally for 12-15 people. If we have the task of delivering passengers quickly from Moscow to St. Petersburg, of course, there is no point in sending a huge airplane, it will not pay off, it will not be fully loaded. Small aircraft can successfully cope with this. On the other hand, it is no longer able to fly across the ocean. The same is true in the energy sector: large-scale power engineering solves the problem of power supply to the economy of the whole country, while small-scale distributed power engineering solves the problem of power supply to individual facilities.

The material was prepared using open data from the study by the Energy Center of the Moscow School of Management SKOLKOVO "Distributed Energy in Russia: Development Potential", 2018.

MKS Group is a leading engineering company in Russia, whose core business is the construction of small-scale power generation facilities - turnkey gas piston power plants. For 15 years it has commissioned 53 mini-HPPs in different regions of Russia and abroad. The total capacity of all commissioned facilities of MKS Group amounted to 244 MW. MKS Group is the official Russian dealer and service partner of MWM Austria GmbH.

© MKC Group of Companies LLC, 2020

ru

ru en

en